Auto Insurance Basics: What You Really Need (and What You Don’t)

In most states, drivers are legally required to carry auto insurance. The challenge is that while insurance is mandated, states rarely make it clear what type or level of coverage is actually necessary. To make matters worse, many drivers end up overpaying for insurance they don’t need—money that could otherwise be put toward paying down debt or investing for the future.

This article breaks down the essential parts of an auto insurance policy. We’ll cover the core types of coverage, which optional add-ons are worth considering, and how to decide what makes sense for your situation. By the end, you’ll know how to stay properly insured without wasting money on coverage you’ll never use.

Why Auto Insurance Matters

Auto insurance isn’t just a legal requirement—it’s a vital financial safety net. In Alabama, for example, failing to carry insurance can result in a $500 fine. Beyond the law, accidents are expensive: a simple sideswipe can cost around $3,800, and a rear-end collision may run upwards of $13,000.

Insurance protects you from these financial shocks. It covers liability, property damage, and medical bills up to your coverage limits, saving you from shouldering massive out-of-pocket expenses. In short, auto insurance keeps both your finances and peace of mind intact.

The Core Coverage Types

- Liability – Required by law in most states, liability coverage pays for injuries and property damage caused by you. That includes other vehicles, fences, mailboxes, and more.

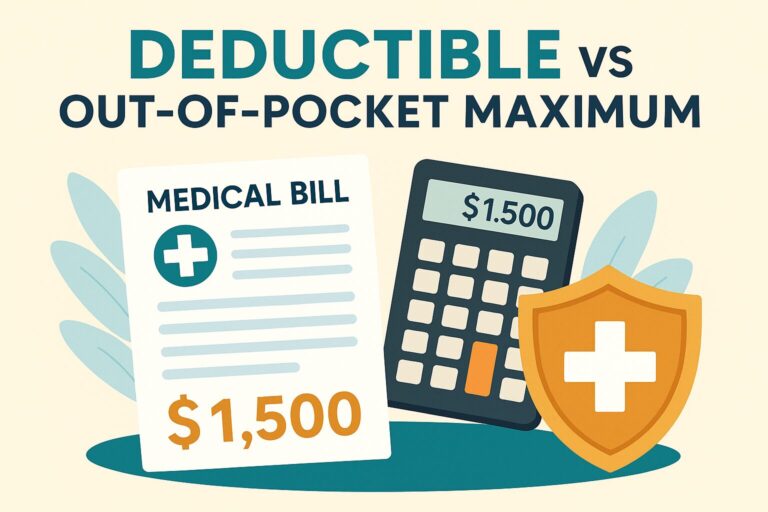

- Collision – Covers repairs to your car after an accident, minus your deductible. If your car is totaled, it pays out its current market value.

- Comprehensive – Protects against damage not caused by a collision—like hail, theft, fire, or a cracked windshield from road debris.

- Uninsured/Underinsured Motorist – Covers your car and medical costs when the at-fault driver has little or no insurance.

Optional Coverage: Do You Really Need It?

- Roadside Assistance – Provides help for flat tires, dead batteries, or running out of gas.

- Rental Reimbursement – Pays for a rental car while your vehicle is in the shop. Some insurers even provide the rental directly.

- Gap Insurance – Covers the difference between your car’s value and your loan balance if the vehicle is totaled. Often cheaper when purchased through the dealer at the time of financing.

- Extended Medical Payments – Covers medical expenses and even funeral costs for all parties involved in an accident, regardless of fault.

How to Decide What’s Right for You

Choosing the right coverage depends on a few factors:

- Car Value & Age: A brand-new car should have full coverage, including comprehensive, collision, and (if financed) gap insurance. For older cars, liability-only may suffice.

- Driving Habits: Long commutes or frequent travel might justify broader coverage.

- Location: If luxury cars are common in your area, consider higher liability limits.

- Discount Programs: Some insurers offer telematics devices that track driving habits for potential discounts. While they can save money, weigh the tradeoff in privacy.

The bottom line: newer, financed cars demand more coverage. Older, paid-off vehicles can often get by with just liability.

How to Save Money on Auto Insurance

- Bundle Policies: Combine home and auto with the same insurer.

- Raise Deductibles: Consider increasing collision deductibles to $1,000 (from $500) and comprehensive to $500 (from $250).

- Ask About Discounts: Safe driver, good student, low-mileage, or telematics discounts can all lower your rate.

Conclusion

The right amount of coverage is just enough to protect your finances from lawsuits and major repair bills—nothing more, nothing less. Liability coverage is non-negotiable, and collision and comprehensive are highly recommended if your vehicle has significant value. Optional add-ons like medical payments or gap insurance can be worthwhile depending on your situation, but avoid paying for extras that don’t serve your needs.

Always review your policy annually, shop around for better rates, and adjust coverage as your car and circumstances change.

To explore this concept further, visit our main Taxes and insurance page.

So, what’s the one part of your policy that still leaves you scratching your head? Drop your question in the comments—I’d be glad to clear it up.