Cash Envelope System: A Proven Way to Take Control of Spending

Introduction

Many people struggle to stick to a budget—not because they lack discipline, but because they don’t track their spending in real time. It’s easy to swipe a card, take the item home, and toss the receipt without a second thought. The problem is that without visibility, money slips away quietly.

The cash envelope system may feel old-fashioned in our digital world, but it’s one of the most effective tools for reigning in overspending. When the envelopes are empty, spending stops until the next pay period. It’s simple, it’s tangible, and it works.

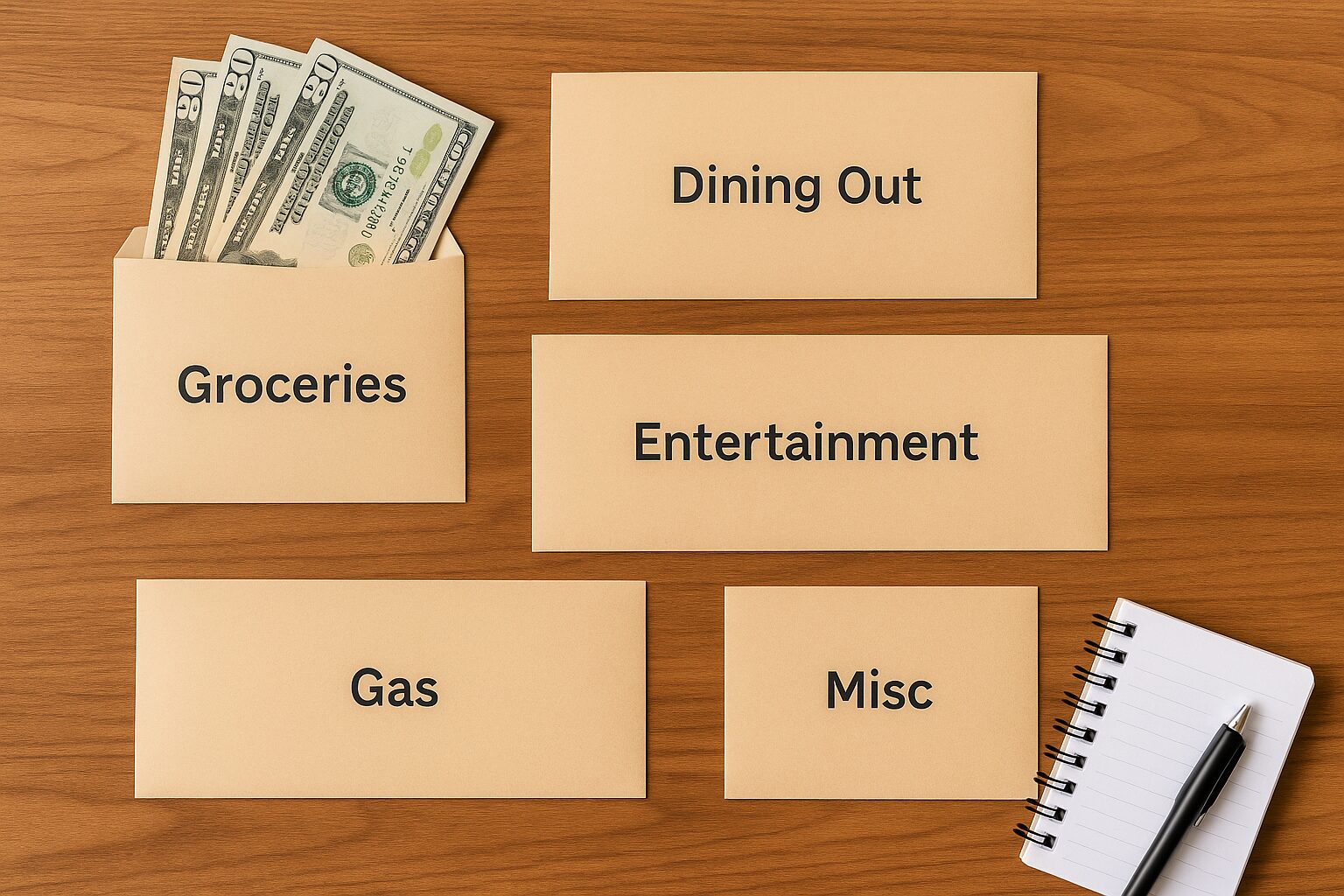

Here’s how the system works: you label envelopes by category, stuff them with your budgeted amount of cash, and spend only from those envelopes. Once an envelope is empty, that category is closed for the month. By creating this hard limit, you’ll start building better spending habits from the very first month.

1. What Is the Cash Envelope System?

The cash envelope system has been around for decades, though it was popularized in recent years by Dave Ramsey. At its core, it’s a simple method to control discretionary spending and free up money for debt payoff or savings.

Why cash? Because cash is psychologically different from plastic. Swiping a card feels painless—you don’t actually see the money leaving. But handing over a $20 bill creates a small sense of loss. That “ouch factor” makes you think twice about every purchase.

If you’re struggling to get control of your spending, this system is worth trying.

2. How to Set Up the Cash Envelope System

Setting it up is straightforward:

- Choose categories you tend to overspend in (groceries, eating out, entertainment, etc.).

- Decide budget amounts for each category based on your income and priorities.

- Label envelopes with category names.

- Stuff them with cash at the start of the month or pay period.

- Spend only from the envelope until it’s empty.

You can also track envelope balances on the back of each envelope, or use apps like Quicken or EveryDollar for a digital backup.

3. Pros of the Cash Envelope System

- Keeps spending under control—you can’t overspend once the cash is gone.

- Builds awareness—you see your money leaving and what it’s buying.

- Works especially well for discretionary spending (happy hours, coffee runs, impulse buys).

- Provides an immediate spending curb—you’ll notice results in the very first month.

4. Cons & Common Challenges

- Not practical for bills, subscriptions, or most online purchases.

- Carrying cash can feel inconvenient—or even unsafe if you’re holding large amounts.

- You’ll be tempted to “borrow” from one envelope to cover another.

- Requires consistency—slipping back into card use can undo progress.

5. Modern Alternatives & Adaptations

In a cashless world, you can still adapt the system:

- Digital cash envelopes – Apps like GoodBudget, Mvelopes, or EveryDollar replicate the envelope concept.

- Prepaid debit cards – Load each with a budgeted category amount.

- Hybrid approach – Use cash for discretionary categories (like dining out), and digital tracking for fixed bills.

- Credit card tracking – Use one card, but log each transaction into digital envelopes (requires discipline).

The principle is the same: spend only what’s in the “envelope,” even if it’s digital.

6. Tips for Making the System Work

- Start small with just two categories, like groceries and dining out.

- Store envelopes in a safe, consistent place.

- Combine it with Zero-Based Budgeting for complete control.

- Create a sinking fund envelope for emergencies (car repairs, medical bills).

- Stick to the rules—no stealing from other envelopes.

- Use saved funds from spending envelopes and the sinking fund for debt paydown at the end of the month,

7. Who Is the Cash Envelope System Best For?

This system is especially effective for:

- People who overspend on wants (therapy shoppers, impulse buyers).

- Beginners who need a simple budget that works.

- Visual learners who like seeing money move.

On the other hand, high-income or complex households may find traditional budgeting software more efficient.

Conclusion

The Cash Envelope System is one of the simplest and most effective ways to build spending discipline. By using cash and assigning it to categories, you force yourself to live within your means—when the envelope is empty, you stop.

It won’t replace a full budgeting system, but it works beautifully for discretionary spending. Try it for just one month with groceries or dining out, and you’ll likely see your spending drop immediately.

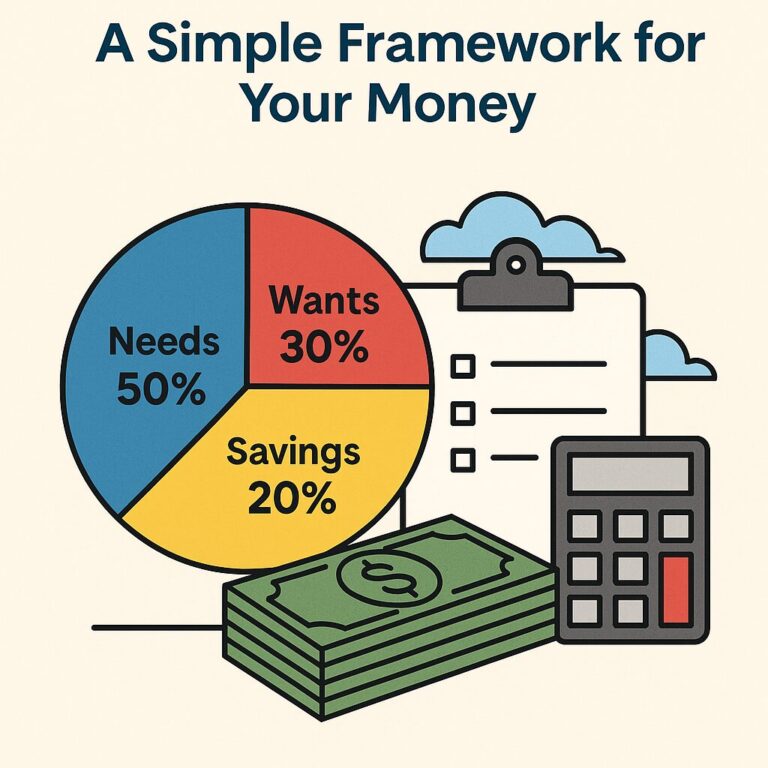

This method also pairs perfectly with the 50/30/20 Rule or Zero-Based Budgeting, giving you a straightforward framework to manage both fixed and variable expenses.

To explore this concept further, visit our main budgeting page.

So—have you tried the Cash Envelope System? How did it work for you? Share your experience in the comments below.