How to Align Your Lifestyle With Your Financial Goals

Most people set financial goals on paper (save more, pay off debt, invest for the future) but then live a lifestyle that pulls in the opposite direction. The fact is, your financial plan won’t stick unless your daily habits, choices, and values are aligned with those goals. When your lifestyle supports your financial vision, money becomes a tool for freedom. This article will show you how to bridge the gap between the life you want to live and the money plan that makes it possible.

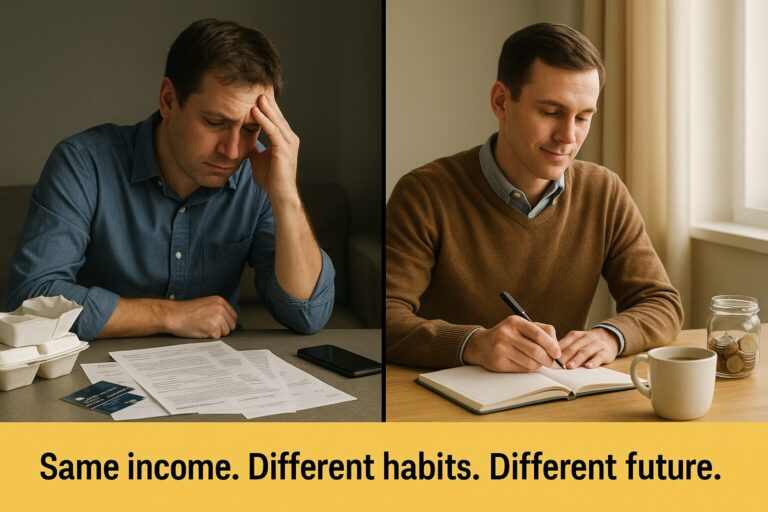

Most people set financial goals on paper (save more, pay off debt, invest for the future) but then live a lifestyle that pulls in the opposite direction. The fact is, your financial plan won’t stick unless your daily habits, choices, and values are aligned with those goals. When your lifestyle supports your financial vision, money becomes a tool for freedom, not a source of stress.

This article will show you how to bridge the gap between the life you want to live and the money plan that makes it possible. By the end, you’ll have a clear path to align your spending, saving, and daily decisions with the future you truly want.

Why Does Lifestyle Alignment Matter?

Many people set financial goals but live in ways that constantly sabotage them. If your lifestyle and your money goals don’t match, you’ll always feel stuck. It feels like running on a treadmill—lots of movement but no progress.

Alignment means shaping daily choices so they support the future you want. At the core, it’s about being honest with yourself about what you truly value (and what you’re willing to sacrifice).

For example, if early retirement is your dream but you spend every dollar of every raise on new toys, you’re making decisions today that keep you from tomorrow’s freedom. On the flip side, if travel is your “joy point” but you funnel every extra cent into a retirement account you won’t touch for 30 years, you’ll miss experiences that matter to you in the present.

The magic happens when your lifestyle (the way you live day to day) lines up with your priorities. That’s when your money plan feels natural and sustainable instead of like punishment.

Building Financial Goals Around Your Lifestyle

As I hinted above, you have to know what you want. Mel Abraham calls this identifying your “joy points.” That might look like a McMansion in the suburbs, or maybe it’s a rustic cabin in the Tennessee foothills. For some, it’s the ability to take three months off a year to travel.

The point is, you can’t build financial goals until you’re clear on the lifestyle you’re aiming for. Without clarity, you’ll chase random goals, get distracted by fads, and end up frustrated. Once your goals are clear, focus on the financial habits that build wealth day-by-day.

So, let’s build this step by step.

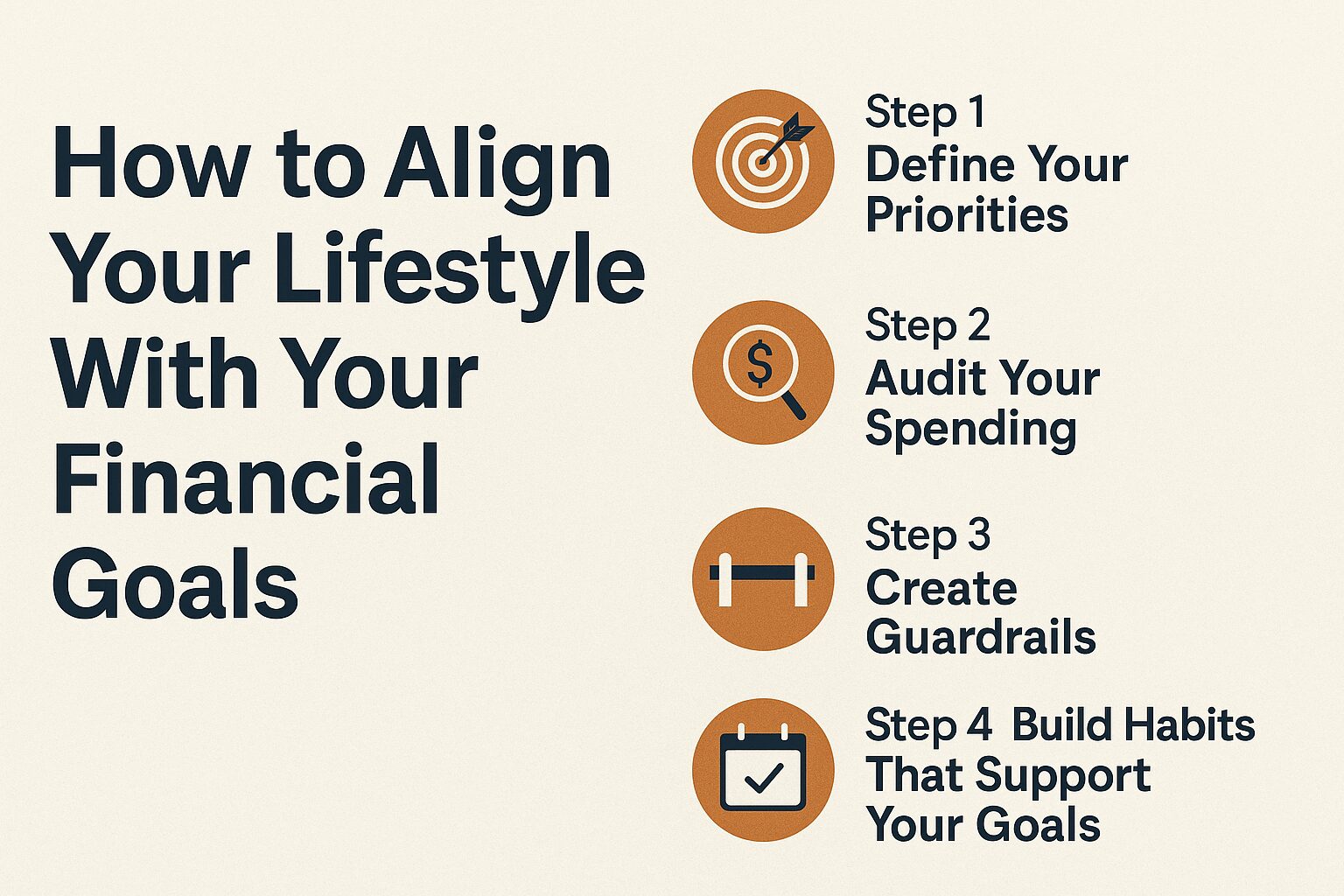

Step 1: Define Your Priorities

Start by asking: What matters most to me? Is it:

- Traveling the world?

- Retiring early?

- Owning your dream home?

- Becoming debt-free as fast as possible?

- Building a safety net so money stress never keeps you up at night?

Without clarity, it’s easy to spend money on things that don’t move you closer to your dreams. Most people don’t have a spending problem, they have a priorities problem.

Write these priorities down. Put them on paper, in your notes app, or even on a vision board. Until they’re written, they’re just wishful thinking.

Tools That Help Define Goals

If your top priority is debt payoff, I recommend Quicken. Once set up, Quicken shows you exactly how long it will take to pay down your debt, plus how much faster you can be debt-free by adding extra principal payments. This makes your debt payoff plan real, not just a guess.

If Quicken isn’t in the budget yet, try free online debt calculators. Bankrate’s debt payoff calculator is simple but powerful, giving you a clear picture of timelines and interest savings.

For savings goals, Quicken’s built-in tracking feature is useful too. You can set progress markers toward things like a down payment, vacation, or retirement account.

Step 2: Audit Your Spending

Now it’s time for a reality check. Pull up the last three months of expenses and see if they match your goals. If retirement is your stated top priority but 40% of your take-home pay is going toward dining out, then your lifestyle and your goals are out of sync.

This is where budgeting comes in. You could use the 50/30/20 framework (50% needs, 30% wants, 20% savings/debt), and then plug in the Zero-Based Budget (ZBB) to tell the money in those percentage categories what its responsibilities are. With ZBB, every single dollar is assigned a job; whether it’s going toward bills, savings, debt, or fun money. If you’re brand new to budgeting, the Consumer.gov guide to budgeting basics is a great simple overview before you dive deeper into frameworks like 50/30/20 or ZBB.”

The trade-off? You’ll need to check in weekly, especially at the start. But the payoff is huge: you’ll know exactly where your money goes and why.

Recommended Budgeting Tools

- EveryDollar: A simple, inexpensive tool that works great if most of your bills are automated through your bank account.

- You Need A Budget (YNAB): Perfect for those who want to build strong money habits and love detailed planning.

- Quicken: Best for people who use credit cards strategically, want a full financial dashboard, or like to see debt payoff timelines alongside investment tracking.

Step 3: Create Guardrails

Guardrails are what keep you safe on the financial highway. Without them, it’s too easy to drift off course.

Think of them not as restrictions, but as protection. They give you room to breathe while making sure your money is still working for your bigger picture.

Practical Guardrail Examples

- Entertainment Cap: While paying off debt, I limit myself to $100/month for entertainment. Later, when debt is gone, I can raise it.

- Automatic Savings: Even while paying down debt, I send a set amount to savings every paycheck. That way, emergencies don’t send me back into the debt spiral.

- Housing Choices: Avoid overextending on rent or a mortgage. Freeing up cash flow for investing or saving is often worth far more than living at the edge of your means.

Guardrails don’t kill freedom,they create it. Without them, you’re one swipe away from undoing months of progress.

Step 4: Build Habits That Support Your Goals

Habits are where the rubber meets the road. Everyone wants financial freedom, but few build the habits that support it.

The truth is, most financial progress comes from boring consistency:

- Cooking more meals at home.

- Driving a reliable used car instead of upgrading every three years.

- Automatically increasing 401(k) contributions when you get a raise.

It’s not glamorous, but these habits build wealth.

And click here to find out about hidden habits that will build wealth for you.

The Opportunity Cost of Flashy Spending

Those dollars going into fancy cars, designer brands, or the latest gadgets could be compounding in an investment account. A $400/month car payment invested at 8% annually for 20 years grows to over $235,000. That’s the real cost of chasing the appearance of wealth.

I’ve been caught in that cycle myself and had nothing to show for it. Take it from me: it’s better to delay those flashy purchases until your financial foundation is rock solid.

Step 5: Reevaluate Regularly

Life changes, and so should your plan. Jobs, promotions, setbacks, and family changes all shift your priorities. That’s why reevaluating is crucial.

When income rises, avoid lifestyle inflation. Instead, direct new dollars toward progress:

- Pay off debt faster.

- Boost your emergency fund.

- Increase retirement contributions (even a 2% bump makes a massive difference over time).

- Redirect money toward savings goals you wrote down in Step 1.

Think of your financial plan like a GPS. When life changes, it recalculates. The key is to keep steering toward your destination.

Final Thoughts

Financial success isn’t just about numbers, it’s about alignment. When your lifestyle matches your goals, you’ll feel less stress, more control, and steady progress toward the life you want. But when every raise or windfall fuels new spending, you’ll stay stuck in the paycheck-to-paycheck cycle.

The choice is yours: live in alignment with your financial goals, or carry the weight of debt and disorganization.

I’d like to hear from you: What’s one small lifestyle change you could make today to bring your money habits closer to your goals? Share in the comments below! You will get a response back from me, too.