How to Create a Monthly Budget That Actually Works

By Sean – September 1, 2025

Budgets get a bad reputation. Too many people think of them as restrictive, complicated, or something you start in January and give up on by February. But the truth is, a budget isn’t about punishment — it’s about giving yourself a clear plan for how you want your money to work for you.

A budget is the engine that drives your financial plan. Without it, you’re coasting without direction, often spending more than you realize and wondering why you’re still living paycheck to paycheck. Done right, a monthly budget gives you freedom, not limits. It tells your money where to go so you can build savings, pay off debt, and start investing for real wealth.

Let’s walk through why budgets fail, how to choose the right budgeting method, and the tools you can use to create a monthly budget that actually sticks.

Why Create a Monthly Budget?

You might be thinking, “Do I really need a budget?” The answer is simple: if you want to reach any financial goal — whether that’s getting out of debt, building an emergency fund, or investing for financial freedom — you need a roadmap.

A budget is that roadmap. It connects your money mindset (your beliefs about money) with the numbers in your bank account. It turns abstract goals like “I want to retire early” or “I want to stop stressing about bills” into daily spending choices you can actually follow.

Here’s what a budget can do for you:

- Clarity: You know exactly where your money is going instead of wondering why it disappears.

- Control: You stop feeling like your bills or debt are controlling you.

- Confidence: You can make decisions (like upgrading your car or taking a trip) without guilt, because you’ve planned for it.

- Progress: You see your debt shrinking and your savings growing.

Without a budget, you’re flying blind. With one, you have a financial GPS guiding your money.

Why Most Budgets Fail

If budgets are so powerful, why do most people give up on them? There are three big reasons.

Being Too Strict

People set up “perfect” budgets that leave no room for real life. They expect to cut out every coffee, every dinner out, and every little indulgence. But humans aren’t robots. If you make your budget feel like a crash diet, you’ll rebel against it and quit.

Not Being Realistic

If your rent is $1,200 and you’re only budgeting $800 because “that’s what you should spend,” your budget will collapse on day one. Good budgets reflect reality. They may not look perfect at first, but they give you a starting point to improve from.

Not Tracking Your Money

The number one reason budgets fail: people don’t track. A budget on paper or in your head is useless if you don’t compare it to your actual spending. Whether you use Quicken, YNAB, EveryDollar, or even a simple spreadsheet, tracking is the accountability piece that makes your budget real.

Choosing the Right Budgeting Method

There’s no one-size-fits-all budget. The key is to find a structure that fits your personality, your lifestyle, and your goals. Here are the main approaches.

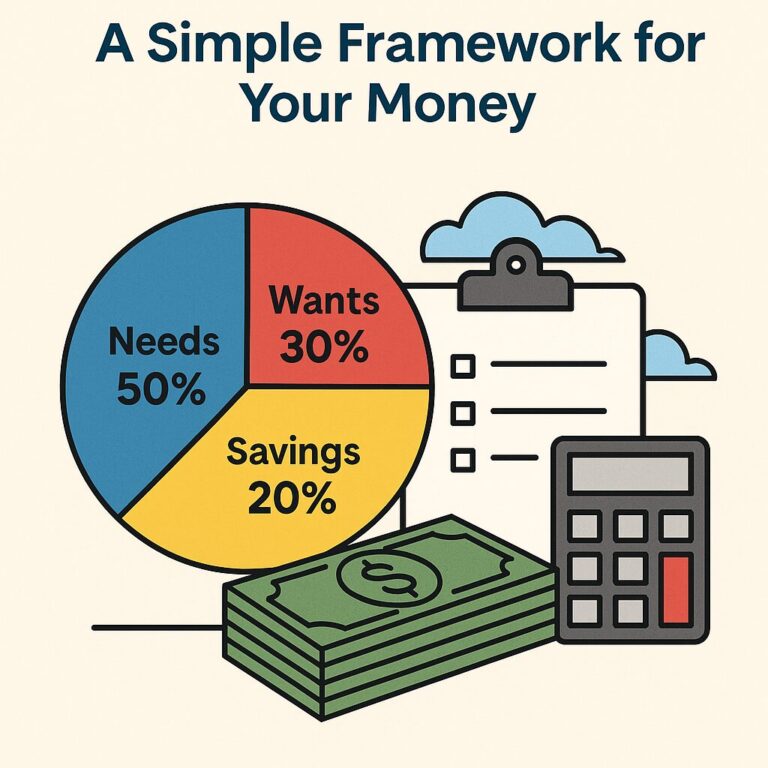

The 50/30/20 Rule (Framework)

Let’s clear this up first: the 50/30/20 rule is not a budget in itself. It’s a framework you can build a budget around.

The idea is simple:

- 50% Needs: Rent, groceries, utilities, transportation, insurance.

- 30% Wants: Dining out, entertainment, shopping, hobbies.

- 20% Savings/Debt: Emergency fund, retirement accounts, paying down credit cards or loans.

Think of it as the blueprint for your spending. Your actual budget (the categories, line items, and tracking) should fit into these buckets.

For example, if your take-home pay is $4,000 a month:

- $2,000 goes to needs,

- $1,200 goes to wants,

- $800 goes to savings and debt payoff.

It’s flexible, realistic, and gives you permission to enjoy life while still prioritizing your future.

The goal isn’t perfection on day one. Maybe right now your “needs” are closer to 70% because of rent or car payments. That’s fine — your budget shows you where you are so you can start shifting closer to balance over time.

Learn more about the 50/30/20 Rule and how to implement it.

Zero-Based Budgeting (ZBB)

With zero-based budgeting, every dollar you earn has a job. Income minus expenses equals zero. That doesn’t mean you spend it all — saving and debt payoff are “jobs” too.

This method works well if you want control down to the penny. It’s great for people who like detail and want to maximize efficiency. Apps like YNAB are built around this approach.

Get more information on the zero-based budget here.

Envelope System

This old-school method still works. You put cash into envelopes labeled “groceries,” “gas,” “fun money,” etc. When the envelope is empty, you stop spending in that category.

Digital versions exist now, but the psychology is the same. The money feels more real, and limits are enforced. Dave Ramsey’s team explains the envelope system here.

Learn more about the cash envelope system here.

Hybrid Budgets

Many people mix methods. For example, you might use the 50/30/20 rule as your framework, but apply zero-based budgeting inside it. Or you could track most categories digitally but still use cash envelopes for problem areas like dining out.

Check out how to take advantage of hybrid debt-paydowns here.

Building a Budget That Fits Your Lifestyle

The most successful budget is the one you’ll actually stick with. Here’s how to align your budget with your real life (and avoid the trap of creating a plan that looks good on paper but falls apart in practice).

Step 1: Know Your Numbers. Write down your total monthly income after taxes. Then list out your expenses, both fixed (rent, car payment, insurance) and variable (groceries, gas, entertainment).

Step 2: Apply a Framework. Use the 50/30/20 rule (or another method) to see where your money should ideally be going. This gives you a target.

Step 3: Compare Reality vs. Ideal. This is the “aha” moment. If your “needs” are eating up 70% of your income, you can’t just wish it into 50%. You’ll need to either raise your income, cut costs, or make a longer-term plan (like downsizing housing or refinancing debt).

Recommended Reading: Your Money or Your Life by Vicki Robin & Joe Dominguez

If you’ve ever felt like your job and bills control your life, this book will change how you think about money forever. Your Money or Your Life reframes money as “life energy” — something you trade your time, attention, and talent for. It shows how to align your spending with your true values and redefine what “enough” means.

This mindset ties directly to budgeting because once you understand the real cost of each dollar, you naturally become more intentional with your choices. The result? A budget that isn’t about restriction — it’s about purpose, freedom, and peace of mind.

Read our full book report: Your Money or Your Life – Aligning Finances With Purpose and Freedom

Step 4: Adjust and Plan Ahead. Budgets aren’t about shaming yourself. They’re about building awareness and making small, sustainable adjustments. If you overspend in one area, adjust another. If your income changes, tweak your categories. Flexibility is key.

Step 5: Track, Track, Track. Whether it’s with Quicken, YNAB, EveryDollar, or Empower, the magic happens when you compare your budget with your actual spending. This is what makes the numbers real.

–>Recommended Reading: The Richest Man in Babylon by George S. Clason

If you’ve ever wondered why some people always seem to make progress while others stay stuck, this book explains why.

The Richest Man in Babylon turns budgeting principles into timeless wisdom — save first, spend second, and let your money work for you.

It reminds readers that budgeting isn’t just about tracking expenses; it’s about building the habits that make investing possible.

Read our full book report: The Richest Man in Babylon – Timeless Rules of Wealth and Prosperity

Tools to Build Your Budget

Budgeting Apps:

- Quicken – A classic tool for tracking all your accounts in one place, great for long-term financial planning and debt payoff projections.

- YNAB – Perfect for zero-based budgeting enthusiasts who want to give every dollar a job.

- EveryDollar – A simple, Dave Ramsey-inspired app for beginners who want a no-frills approach.

There are also other great tools out there that you can use as well. This article from Nerd Wallet mentions some tools that you may want to consider as well.

Spreadsheets: If you like control and customization, Excel or Google Sheets give you the ability to build your own budget from scratch. They also pair well with the 50/30/20 framework.

Old-School Pen and Paper: Sometimes simple is best. Writing things down builds awareness, and you don’t need internet access or logins. The downside is it’s harder to track automatically.

Making Your Budget Stick

Creating a budget is one thing. Living with it month after month is another. Here are a few ways to make your budget sustainable.

- Build an emergency fund first. Even $500–$1,000 keeps you from derailing your budget with every unexpected expense.

- Reward yourself. Include fun money so you don’t feel deprived. This is why the 50/30/20 framework works. It gives you guilt-free space for wants.

- Automate savings and debt payoff. Set transfers to happen automatically so you don’t have to rely on willpower.

- Review monthly. At the end of each month, look at what worked, what didn’t, and adjust. Progress comes from consistency, not perfection.

- Tie it to bigger goals. A budget isn’t just about bills, it’s about creating the life you want. Whether that’s traveling more, retiring early, or buying a home, connect your budget to your vision.

Final Thoughts

A budget isn’t punishment. It’s the bridge between where you are and where you want to be financially. The key is to stop seeing it as a straightjacket and start seeing it as a tool for freedom.

Remember: the 50/30/20 rule is a framework — the budget is how you bring that framework to life. Pick the method that fits your personality, use tools that make tracking easy, and stay flexible.

Your first budget won’t be perfect. That’s fine. What matters is that you start. Each month you’ll get better, and before long, you’ll find yourself hitting goals you once thought were impossible.

So ask yourself: what would your life look like if your money finally lined up with your goals? The answer starts with building a budget that actually works.