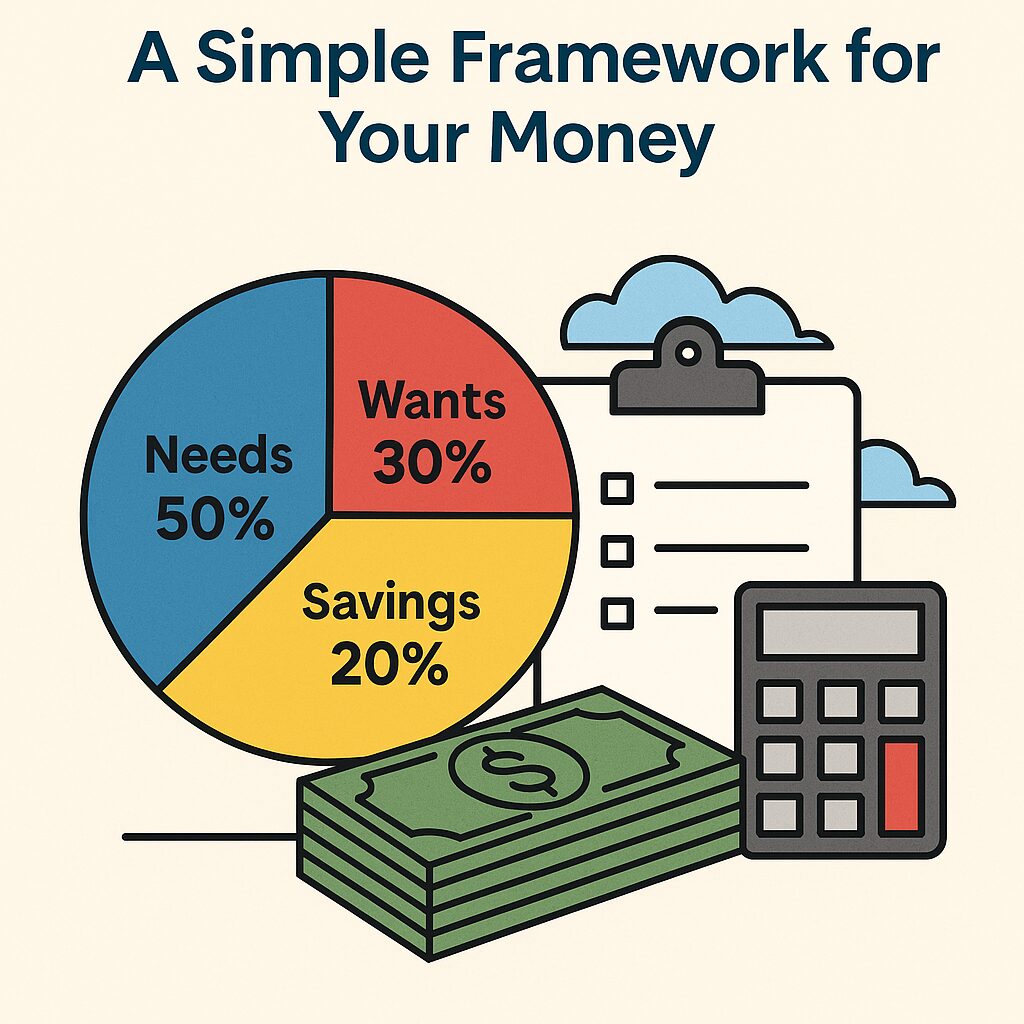

The 50/30/20 Budget Rule: A Simple Framework for Your Money

Introduction

Let’s face it—most people don’t enjoy budgeting. It’s not that we don’t want to know where our money goes; the real issue is that many budgets fail because they don’t account for expenses that sneak up on us. Those “gotcha” bills can derail even the best intentions.

The good news? A budget doesn’t have to be complicated. The 50/30/20 Rule gives you a simple, flexible framework to organize your money into three categories: needs, wants, and savings/debt repayment.

By the end of this article, you’ll know exactly how to set up the 50/30/20 Rule, avoid common pitfalls, and use it as a foundation for a financial plan that works—not just on paper, but in real life.

What Is the 50/30/20 Budget Rule?

The 50/30/20 Rule is a budgeting framework that suggests:

- 50% of your income goes to needs (housing, food, transportation, insurance, etc.)

- 30% of your income goes to wants (fun, hobbies, subscriptions, travel)

- 20% of your income goes to savings and debt repayment (emergency fund, retirement accounts, debt payoff, investments)

This model was popularized in the book All Your Worth by Elizabeth Warren and Amelia Warren Tyagi. Whether you agree with Senator Warren’s politics or not, the framework has become one of the most widely used budgeting strategies because it’s both simple and effective.

What makes it so popular is its balance: you cover essentials, allow room for enjoyment, and still make progress toward financial goals.

Breaking Down the Categories

50% Needs

Needs are the non-negotiables—things you must pay to function in modern society. Think in terms of Maslow’s Hierarchy of Needs: food, shelter, safety, and security. Advertisers try to blur the lines between wants and needs, but stick to the basics.

Examples of true needs:

- Housing (rent or mortgage)

- Utilities (electricity, water, heating/cooling)

- Groceries (basic food from the store, not dining out)

- Transportation (fuel, insurance, basic maintenance)

- Insurance (health, auto/home/renters, life, long-term disability)

- Sinking funds for predictable annual expenses

Pitfall to avoid: lifestyle creep. As income rises, it’s tempting to upgrade to a bigger apartment, nicer car, or luxury conveniences. Keep “needs” at or below 50%—anything beyond that usually drifts into “wants.”

30% Wants

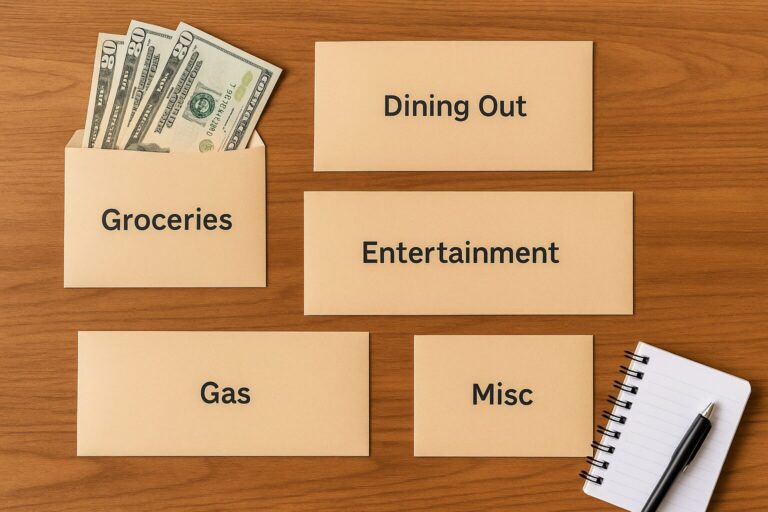

Wants make life enjoyable. They’re not essential to survival, but they bring fulfillment and fun. The key is moderation—wants should be budgeted intentionally, not treated as an afterthought.

Examples of wants:

- Dining out and takeout

- Subscriptions (streaming, apps, gyms)

- Hobbies, gadgets, and entertainment

- Vacations and weekend trips

- Massages, spa visits, manicures/pedicures

- Specialty or luxury foods

Here’s the beauty of the 50/30/20 Rule: it gives you permission to spend guilt-free on wants—as long as they fit in your 30% bucket. No shame, just balance.

20% Savings & Debt Repayment

The final 20% is your pathway to financial independence. It covers debt payoff, savings, and investments.

Step 1: Pay off debt. Start with consumer debt (credit cards, personal loans, car loans). The debt snowball method—tackling the smallest balance first—is highly motivating and effective.

Step 2: Build an emergency fund. Aim for at least 6 months of expenses, then stretch to 12–18 months for maximum security.

Step 3: Invest for the future. Once debt is under control and your emergency fund is healthy, direct money into retirement accounts (401(k), IRA) and long-term investments. Over time, shift the full 20% toward wealth-building.

Benefits of the 50/30/20 Rule

- It’s simple. No complex spreadsheets—just check whether your expenses fit the 50/30/20 ratios.

- It’s flexible. You choose what qualifies as a “want” or “need,” and you can adjust as your situation changes.

- It’s balanced. Unlike strict “beans and rice” budgets, this framework makes room for fun and future planning.

- It’s a framework, not a prison. Think of it as training wheels for your money mindset. Once you commit to the ratios, the money naturally falls into place.

Common Mistakes & Misconceptions

- Misclassifying wants as needs. The latest phone, luxury car, or brand-name clothing are not essentials—they’re wants.

- Forgetting irregular expenses. Annual subscriptions, car insurance paid semiannually, and property taxes can blow up a budget if not planned for. Use sinking funds.

- Assuming one-size-fits-all. If you live in a high-cost-of-living area, your needs may exceed 50%. That’s okay—just adjust and rebalance over time.

- Not seeking professional advice. Budgeting isn’t just about cutting expenses. Consider saving for an annual check-in with a CPA or financial advisor to uncover tax deductions or credits you might otherwise miss.

How to Start Using the 50/30/20 Rule

- Track your last 3 months of spending. This gives you a clear picture of where your money is actually going.

- Categorize expenses into needs, wants, and savings/debt. Be honest—some “needs” may really be “wants.”

- Adjust to fit the ratios. This might mean canceling subscriptions, downsizing housing, or increasing income through a side hustle.

- Use budgeting tools. Apps like YNAB, EveryDollar, or Quicken make tracking simple and consistent.

The process may feel awkward at first, but once you find your rhythm, it becomes second nature.

Alternatives and Adjustments

The 50/30/20 Rule is powerful, but it’s not the only option.

- Zero-Based Budgeting (ZBB): Every dollar gets assigned a job. You can combine ZBB with 50/30/20 for added accountability. You can read more about Zero-Based Budgeting here.

- 75/15/10 Plan (popularized by Jaspreet Singh): 75% for needs/wants, 15% for investments, 10% for savings. It adjusts as debt is paid down and savings grow.

- Custom ratios: Some people shift wants down to 20% and savings up to 30% when tackling high-interest debt or aggressive savings goals.

The bottom line: the framework is flexible. Use it as a guide, then adjust as your life and goals evolve.

Conclusion

The 50/30/20 Rule works because it’s simple, flexible, and balanced. You don’t have to deprive yourself—you just have to live within the framework. Cover your needs, allow for wants, and prioritize your financial future. You know…A budget that actually works for you.

What part of your budget do you struggle most with—needs, wants, or savings? Share below, and let’s talk about it.