Zero-Based Budgeting: How to Take Total Control of Your Money

Introduction

Most people build their budgets around what they spent last month. That’s fine—until an annual bill suddenly comes due and throws everything off. Then you’re scrambling to adjust your budget mid-month.

Zero-Based Budgeting (ZBB) takes a different approach. Instead of recycling last month’s numbers, you sit down before each month begins and decide exactly where every dollar will go. Nothing is left unassigned. Rent, groceries, savings, debt payoff—even a buffer for irregular bills—all have a purpose.

In this post, you’ll learn what Zero-Based Budgeting is, why it works, the pros and cons, and how to set one up. You’ll also see how it compares to other budgeting methods and get a step-by-step example you can copy.

What Is Zero-Based Budgeting?

Zero-Based Budgeting means every dollar has a job. Nothing is left floating in your account as “extra” or “spending money.”

For example, you might set aside money for:

- Rent or mortgage

- Utilities (electric, internet, water, sewer)

- Groceries

- Transportation

- Emergency fund

- Debt payoff

- Savings or investments

By the end of the month, your income minus expenses should equal zero. That doesn’t mean you spend every dollar—you’re also “spending” on savings, debt reduction, or investments.

This approach helps prevent overdraft fees, bounced payments, and declined cards. Instead of relying on your bank balance (which may not reflect pending transactions), you spend according to the plan you created.

Interestingly, ZBB originated in Corporate America. Peter Pyhrr developed it at Texas Instruments in the 1970s to force companies to justify every budget line item rather than copy last year’s numbers. Today, it’s just as effective on Main Street as it was in the boardroom.

Why Zero-Based Budgeting Works

- Forces intentionality. You stop guessing where money goes and decide ahead of time.

- Eliminates “leaks.” Evaluating line items each month reveals what’s worth cutting.

- Builds discipline. Following ZBB helps develop the habits needed for debt payoff and long-term saving.

- Creates guilt-free spending. If it’s in the budget, you can enjoy it without worry.

- Provides clarity. You always know exactly where your money is going, instead of being surprised by overdrafts.

How to Set Up a Zero-Based Budget

- List all income sources (paychecks, side hustles, passive income).

- Track all outflows (needs, wants, debt payments, savings goals).

- Assign every dollar until your budget equals zero.

- Account for variable expenses like utilities, fuel, and food.

- Use tools or envelopes to track spending.

- Review weekly to stay on track.

Simple in theory, but challenging in practice—the hardest part is breaking old spending habits.

Tools & Methods to Make ZBB Easier

- YNAB (You Need a Budget): Built specifically around ZBB. Assigns money to categories before you spend.

- EveryDollar: Based on Dave Ramsey’s system. Easy to use and beginner-friendly.

- Quicken: A full financial tracker that integrates with all accounts, including debt.

- Spreadsheets (Excel or Google Sheets): Free and customizable, but less automated.

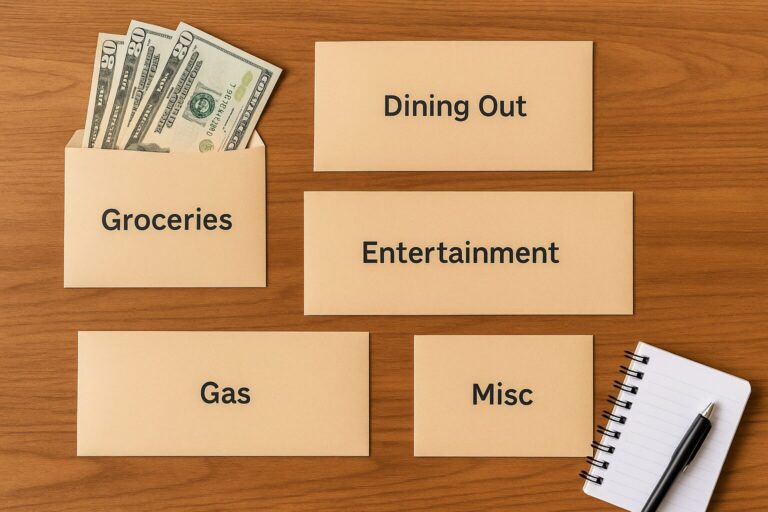

- Envelope System: Cash or digital. The physical method adds friction—once the envelope is empty, you’re done.

Whichever method you choose, consistency is key. Weekly check-ins keep you from overspending.

Benefits of Zero-Based Budgeting

- Full control over your money.

- Stops overspending and lifestyle creep.

- Works well for irregular income (especially with YNAB).

- Accelerates debt payoff and savings growth.

- Makes you more mindful of financial choices.

Challenges & Common Mistakes

- Time-intensive setup. Especially at first, and even more so if budgeting with a partner.

- Feels restrictive. Switching from “bank balance budgeting” takes adjustment.

- Too many categories. Keep it simple—otherwise it becomes overwhelming.

- Forgetting emergencies. Always budget for unexpected expenses with a sinking fund.

ZBB vs. Other Budgeting Methods

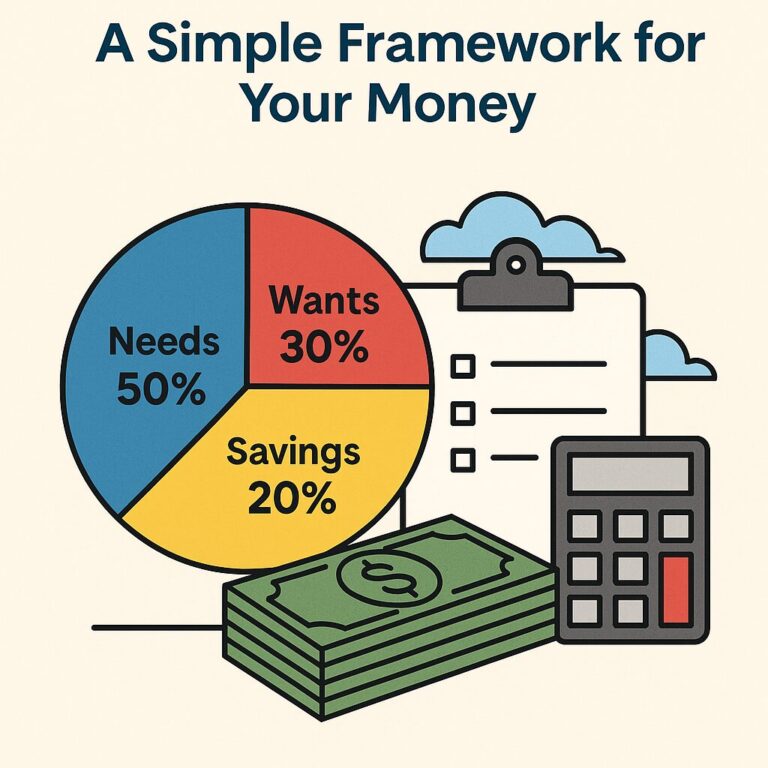

- 50/30/20 Rule: Broad guideline (needs, wants, savings). Great framework, but less detailed.

- Envelope System: Good for problem categories (like eating out), but rigid.

- Zero-Based Budgeting: Pairs well with both—ZBB provides detail, while 50/30/20 keeps balance, and envelopes enforce discipline.

You don’t have to pick just one. Many people successfully blend them.

Who Should Try Zero-Based Budgeting?

- People paying off debt.

- Anyone who feels money “slips through their fingers.”

- Households with variable income.

- Anyone seeking more clarity and control.

Step-by-Step Example Budget

Let’s say your monthly income is $4,000:

- Rent: $1,400

- Utilities: $180

- Groceries: $500

- Transportation/Fuel: $200

- Fun/Miscellaneous: $200

- Debt payoff: $1,200

- Savings: $520

- Leftover: $0

Every dollar is accounted for—income minus expenses = zero.

Conclusion

The beauty of Zero-Based Budgeting is clarity. You see where your money will go before the month even begins, which makes it easier to cancel unnecessary subscriptions, cut back on expenses, and stay disciplined.

If you’ve struggled with cash flow or debt, challenge yourself to try ZBB for just one month. It may feel restrictive at first, but the control and peace of mind you’ll gain are worth it.

To explore this concept further, visit our main budgeting page.

Have you ever tried Zero-Based Budgeting? Share your experience in the comments—I’d love to hear how it worked for you.